What is Modo Loan ? All About Modo Loan

Modo Loan is an online service that offers payday loans. They focus on giving people quick and easy access to short-term loans. Modo Loan promises fast approvals, flexible repayment options, and clear terms.

Key Features of Modo Loan

- Loan Amounts: Modo Loan provides loan amounts ranging from $100 to $5,000.

- APR Rates: The annual percentage rate (APR) ranges from 5.99% to 35.99%.

- No Upfront Fees: Modo Loan does not charge any upfront fees or costs.

- All Credit Scores Welcome: Modo Loan accepts applications from people with all types of credit scores.

Example of Modo Loan Finance

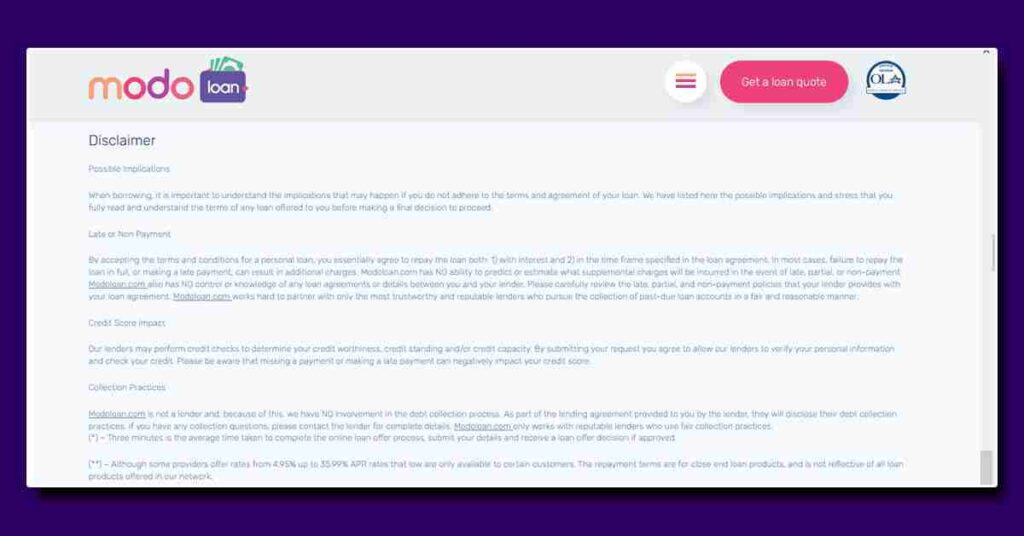

If you borrowed $5,000 for 48 months with an 8% arrangement fee ($400), your monthly repayments would be $131.67. The total amount you would repay is $6,320.12. This includes the 8% fee, making the total cost of the loan $1,720.12. The representative APR for this loan is 18.23%.

Modo Loan Scam or legit Overview

Modo Loan has both good and bad reviews on the internet, but it’s a very disappointing point that this website is not listed on Trustpilot. So, we can’t say for sure if it is 100% legit. Here are some possible scam signs . So read very carefully before apply for a loan.

Modo Loan legit Or Scam – Apply or Not ?

If you want to know is modo loan safe , then Read this , Modo Loan has received mixed reviews on the internet, making it difficult to determine its legitimacy.

1. Absence from Trustpilot:

Modo Loan’s absence from Trustpilot makes it hard for potential borrowers to trust its reliability and customer satisfaction.

2. Suspect Reviews and Testimonials:

There may be fake reviews and testimonials on Modo Loan’s website, which could mislead potential customers.

3. High Processing Fees:

Many customers have reported high processing fees and poor customer support service when dealing with Modo Loan.

4. Hidden Terms and Conditions:

The website may contain hidden terms and conditions in fine print, potentially impacting borrowers through late or non-payment penalties and affecting credit scores. All text is in very small hard to read

5. Affiliate Networks:

The involvement of affiliate networks raises questions about the service’s legitimacy, as creators and marketers may earn high commissions for referring customers.

6. Limited Contact Options:

Modo Loan only provides an email address for contact purposes, with a commitment to respond within 48 hours, which some users find very slow and poor customer service .

7. No Proof of Loan Disbursement:

There is no publicly available evidence that customers have successfully received loans through Modo Loan, which raises doubts about its effectiveness as a lending service.

8. Few Users:

Modo Loan does not have many users. This makes it hard to find real experiences from people who have used their service. It is difficult to know if it works well or not.

9. No Social Media Accounts.

Modo Loan only provides only an email address. There is no social media like You tube , Instagram , so it makes it hard to contact and trust.

Modo Loan Review and Complaints

Many customers have complaints about Modo Loan. Some people find it hard to trust because it is not listed on Trust pilot. Others say that Modo Loan has very high processing fees and slow, unhelpful customer support. This company has very few users, which also makes it hard to trust.

Most Important Slow and Poor Customer Support:

Customers have reported that Modo Loan’s customer support is very slow and not helpful. If you have a problem, it might take a long time to get any help.

3 Most Important Tips to Spot Scams Like Modo Loan

Check for Trustpilot Reviews:

If a company is not listed on Trustpilot or has very few reviews, it might be a red flag. Trustpilot is a popular site where real people share their experiences with companies.

Look Out for High Fees and Hidden Costs:

Be wary of companies that charge very high fees or have hidden costs. Always read the fine print to understand all the terms and conditions, especially any fees that are not clearly stated upfront.

No Customer Support:

Good customer support is crucial. If a company only offers email support and takes a long time to respond, or if many reviews mention poor customer service, it’s a sign that the company might not be reliable. Always look for companies with accessible and helpful customer service.

Modo loan phone number Modo Loan Customer Service

- Modo Loan does not have a phone number on their website, which makes it harder to trust them. They aim to respond to all inquiries within 48 hours.

- You can email them at customers@modoloan.com. Before emailing, check their frequently asked questions (FAQs) to see if your question is already answered.

- The lack of a phone number can be a concern for some people who prefer to talk to someone directly.

What Are Modo Loan Requirements?

Anyone can apply for a Modo Loan, but there are some basic requirements you must meet. These include being over 18, having a checking account, a permanent address, and a regular income.

1. Be Over the Age of 18:

You must be at least 18 years old to apply for a Modo Loan.

2. Have a Checking Account:

You need to have a checking account. This is where the loan money will be deposited.

3. Permanent Address:

You must have a permanent address. This means you need a stable place where you live.

4. Have a Regular Income:

You need to have a regular income. This shows that you can repay the loan.

These are the main requirements to qualify for a Modo Loan. Make sure you meet all of them before you apply.

What Are Modo Loan Pros and Cons?

Modo Loan has some good and bad points. It offers quick and easy loans, but there are also high fees and slow customer support. Here are the pros and cons in detail.

Pros of Modo Loan

1. Quick Loan Approval:

Modo Loan approves loans quickly, so you can get the money you need fast.

2. Flexible Loan Amounts:

You can borrow between $100 and $5,000, giving you flexibility depending on your needs.

3. All Credit Scores Welcome:

Modo Loan accepts applications from people with all types of credit scores, making it accessible to more people.

4. No Upfront Fees:

There are no upfront fees to apply for a loan, which can be helpful if you need money urgently.

- Borrow for up to 24 months and repay with easy monthly installments.

- Website is 3 years from now. and the Trust Score is too Good.

PLEASE NOTE ALL POINTS ARE ACCORDING TO WEBSITE THERE IS NO PROOF AVAILABLE ON INTERNET.

Cons of Modo Loan

1. High Processing Fees:

Many customers report that Modo Loan charges high processing fees, making the loan more expensive.

2. Slow Customer Support:

Customer support is slow and only available through email, which can be frustrating if you have urgent questions or issues.

3. Not Listed on Trustpilot:

Modo Loan is not listed on Trustpilot, making it hard to know if it’s trustworthy.

4. Few Users and Reviews:

There are not many users or reviews, which makes it difficult to find real experiences and opinions about the service.

What Are Alternatives to Modo Loan?

If you are looking for alternatives to Modo Loan, there are several other options available. These include Low Credit Finance, Heart Paydays, Jungle Finance, 50k Loans, and Green Dollar Loans. Each offers different features that might suit your needs better.

Low Credit Finance:

Low Credit Finance provides payday loans and same day loans online. This is a good option if you need money quickly and have low credit.

Heart Paydays:

Heart Paydays is a leading provider of online installment loans. They offer flexible repayment options, which can make managing your loan easier.

Jungle Finance:

Jungle Finance is a top choice for bad credit payday loans online. They are known for helping people with poor credit scores get the money they need.

50k Loans:

50k Loans is a good option if you are looking for no credit check loans online. This can be useful if you have a low credit score and want to avoid a credit check.

Green Dollar Loans:

Green Dollar Loans offers quick and reliable instant payday loans online. They are known for their fast service, which can be helpful if you need money urgently.

Conclusion

We have shared information about Modo Loan based on our research. This is not our website, so please do your own research before applying for a loan or making any investment. Modo Loan has both positive and negative reviews. If you have any questions, contact us and we will reply soon.

Do Your Own Research:

It’s important to do your own research before deciding to use Modo Loan. Check for more reviews and information to make an informed decisions

RELATED HEALTH PRODUCTS REVIEWS: